reverse tax calculator uk

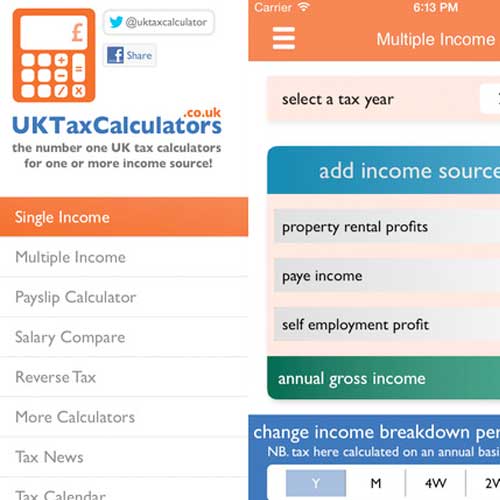

This calculator has pre-programmed tax rates and allowances for the different tax rules for United Kingdom countries - England Scotland Wales and Northern Ireland. Now you divide the items post-tax price by the decimal value youve just acquired.

If you know your tax code you can enter it or else leave it blank.

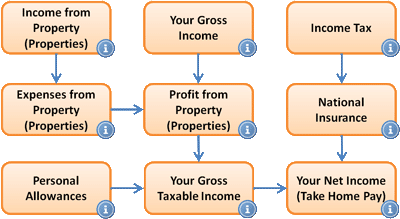

. Use this service to estimate how much Income Tax and National Insurance you should pay for the current tax year 6 April 2021 to 5 April 2022. Youll be able to see the gross salary taxable amount tax national insurance and student loan repayments on annual monthly weekly and daily bases. Net Income - Please enter the amount of Take Home Pay you require.

Check your Income Tax payments for the current tax year 6 April 2021 to 5 April 2022 If youre self-employed use the HMRC self-employed ready reckoner to budget for your tax bill. Reverse Calculate Income Tax - Calculate Net to Gross - Find out how much you need to earn before tax to take home an income you enter - for PAYE CIS and Self Employed. From 1 March 2021 the domestic VAT reverse charge must be used for most supplies of building and construction services.

This will give you the items pre-tax cost. Calculate the VAT element of a price. HST reverse sales tax calculation or the Harmonized reverse Sales Tax calculator of 2022 for the entire Canada Ontario British Columbia Nova Scotia Newfoundland and Labrador and many more Canadian provinces.

Enter the sales tax and the final price and the reverse tax calculator will calculate the tax amount and price before tax. Subtract the price of. For example 60 12 UK VAT rate 50 price without VAT Original figure 60 50 price without VAT.

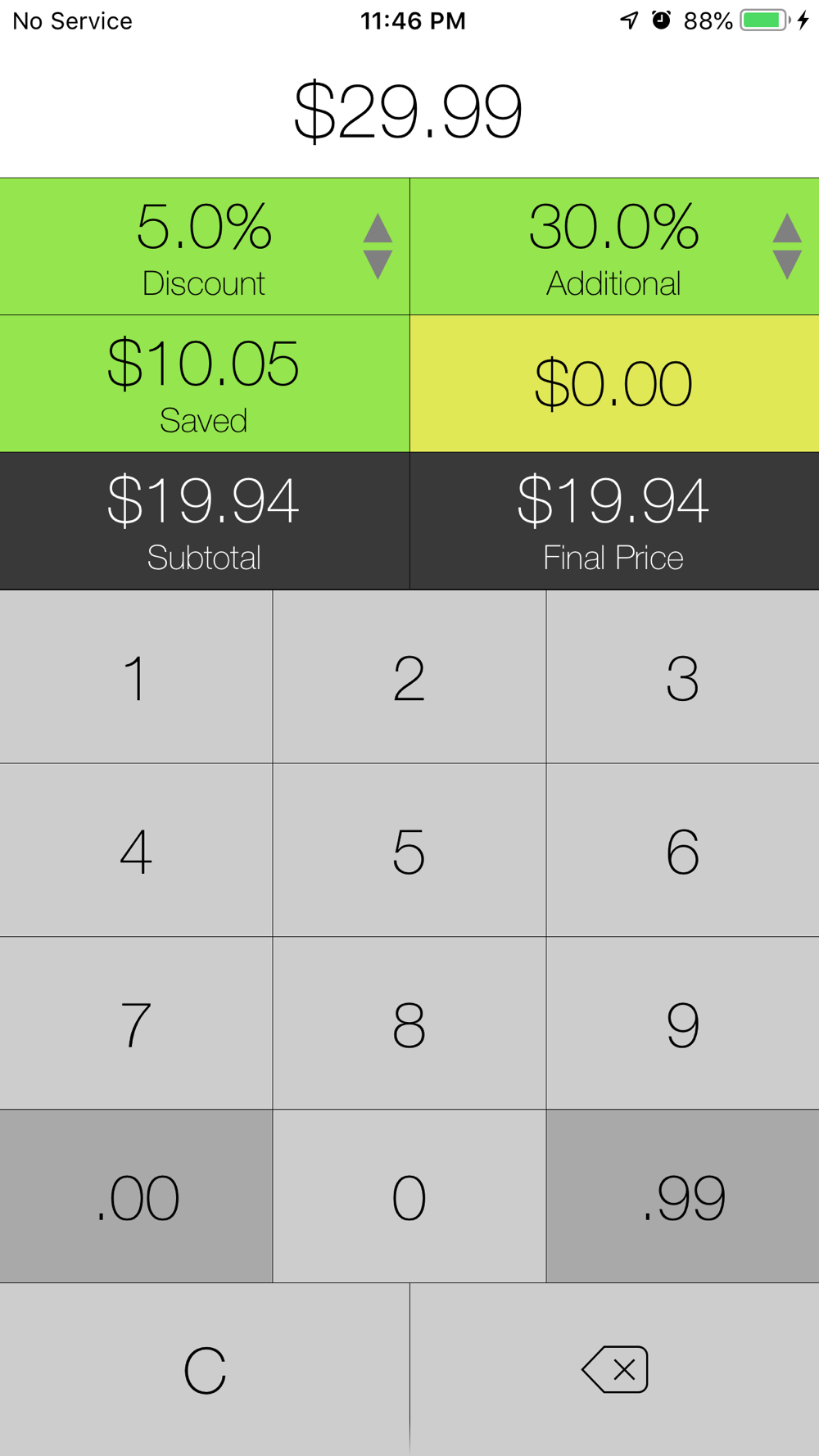

Calculate VAT from the total price of a product or service which includes VAT. Reverse Tax Calculator is a simple financial app that allows you to quickly and easily figure out just how much of that sales total was actually taxes. This app is especially useful to all manner of professionals who remit taxes to government agencies.

Take 20 off a price or any number. All UK tax codes are accepted and will be decoded and automatically checked providing an explanation of the tax code as well as a check to make sure the correct amount of tax is being deducted. Divide the price of the item post-tax by the decimal value.

To start using The Tax Calculator simply enter your annual salary in the Salary field in the left-hand table above. Removing VAT is not 080 try the VAT Calculator to see Calculate the VAT content of a number which is inclusive of VAT. 2675 107 25.

Now you know the amount exclusive of VAT Net amount. You can switch between Income Tax Calculator Monthly Income Tax Calculator and. If this is difficult for you use.

Reverse VAT calculator in UK for 2021 Free calculator of inverted taxes for United Kingdom Do you like Calcul Conversion. Tax Year - Select the Tax Year to calculate tax years start 6th April and end 5th April. Lets calculate this value.

If you want to remove VAT from a figure to make a reverse VAT calculation to divide the amount by 100 VAT percentage and then multiply by 100. How to Calculate Reverse Sales Tax Following is the reverse sales tax formula on how to calculate reverse tax Price Before Tax Final Price 1Sales Tax100 Tax Amount Final Price - Price Before Tax. A Reverse Sales Tax Calculator is useful if you itemize your deductions and claim overpaid local and out-of-state sales taxes on your taxes.

This is the NET amount after Tax the actual amount that you get paid after all deductions have been madeIf you select month and enter 3000 we will calculate based upon you taking home 3000 per month. That means if you have a figure inclusive of VAT Value Added Tax and want to do a vat calculation to remove the 20 VAT then use this reverse VAT calculator. This is based on Income Tax National Insurance and Student Loan information from April 2021.

This calculator is useful if you want to calculate VAT backwards. Amount with sales tax 1 GST and QST rate combined100 or 114975 Amount without sales tax Amount without sales tax GST rate GST amount Amount without sales tax QST rate QST amount Margin of error for sales tax An error margin of 001 may appear in reverse calculator of sales tax. Take the sum you want to work backwards from divide it by 12 1 VAT Percentage then subtract the divided number from the original number that then equals the VAT.

Button and the table on the right will display the information you requested from the tax calculator. The charge applies to standard and reduced-rate VAT services. Tax codes valid as of writing.

This tells you your take-home pay if you do not have. Tweeter Amount with VAT UK VAT UK VAT UK Amount. The only thing to remember about claiming sales tax and tax forms is to save every receipt for every purchase you intend to claim.

If you do any overtime enter the number of hours you do each month and the rate you get paid at - for example if you did 10 extra hours each month at time-and-a-half you would enter 10 15. This calculator works on the current United Kingdom VAT rate of 20.

How To Calculate Income Tax In Excel

Vat Calculator Uk Sale Tax By D App Online Ltd

Hp 16c Scientific Calculator Pocket Calculators Calculator

Uk Tax Calculators Apps On Google Play

2016 17 Tax Calculator App Update Now Available Free In The App Store Uk Tax Calculators

Ultimate Corporation Tax Calculator 2021

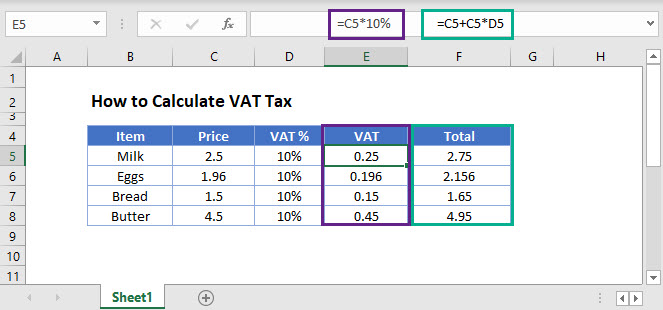

How To Calculate Vat In Excel Vat Formula Calculating Tax In Excel

Facebook Ads Cost Calculator Facebook Free

Landlord Income Tax Calculator Icalculator

Salestaxcalc Sales Tax Tax Calculator

How To Calculate Income Tax In Excel

How To Calculate Vat Tax Excel Google Sheets Automate Excel

Tax Calculator Plugins For Wordpress Wpxpress

Sales Tax Calculator And De Calculator Sales Tax Tax Calculator